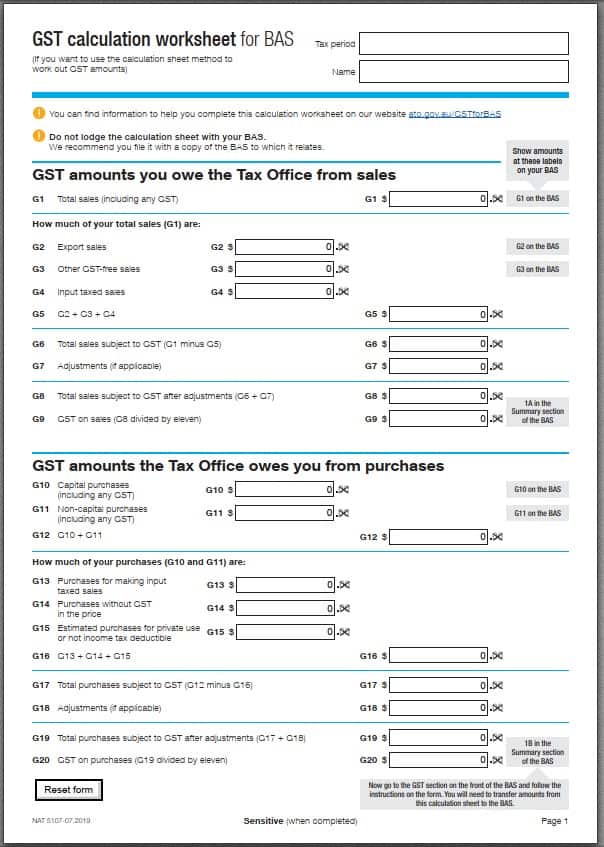

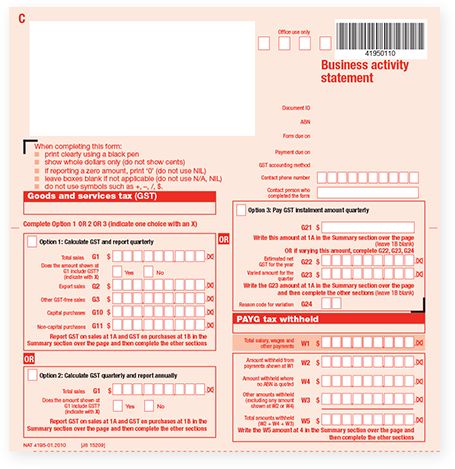

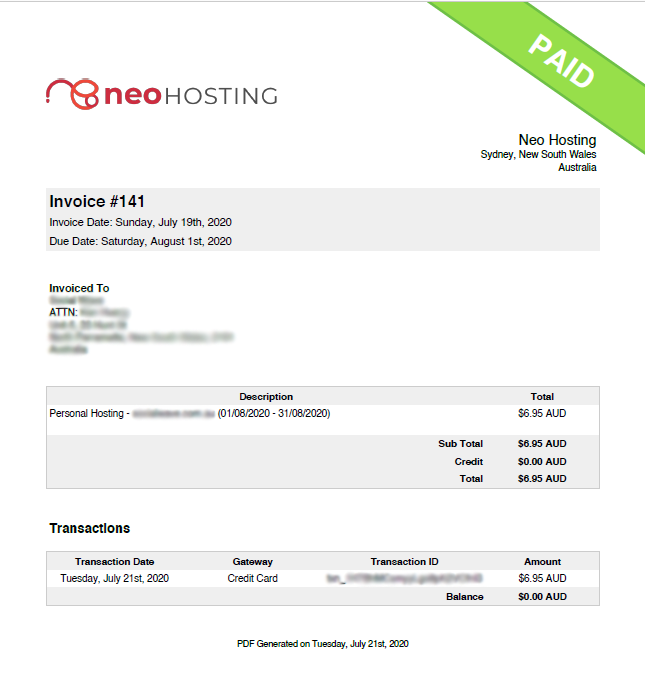

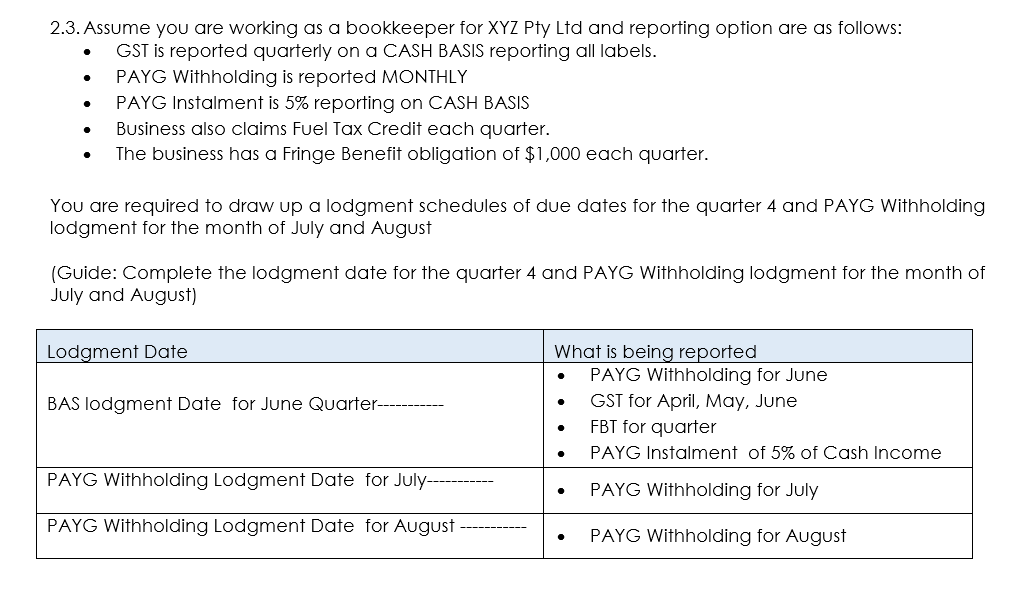

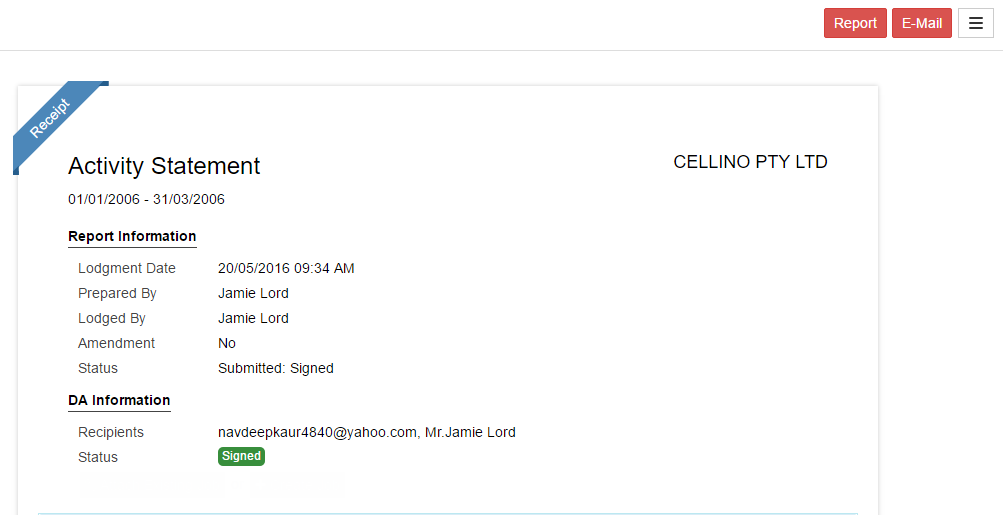

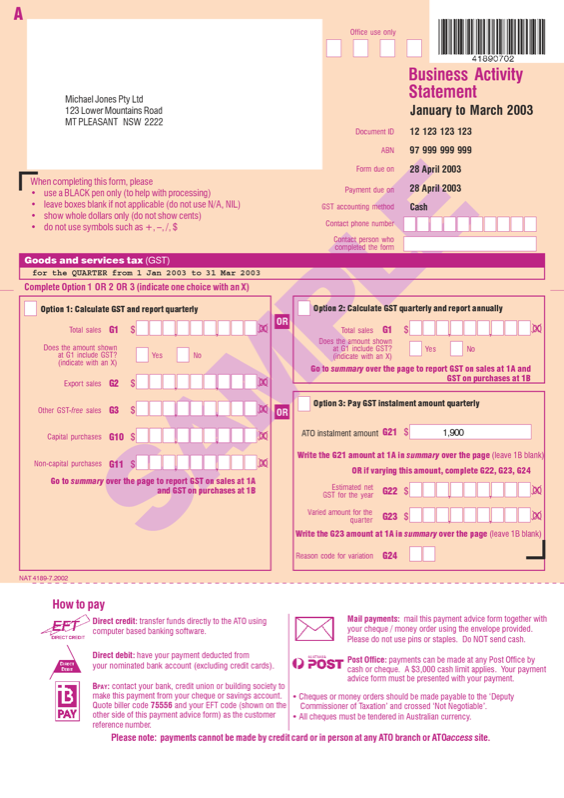

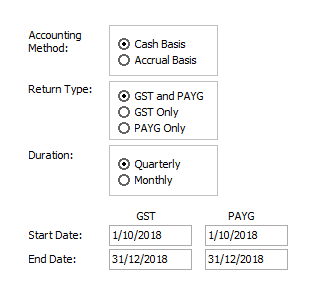

Acceptable BAS evidence: 1. A copy of your most recently lodged BAS for the 2019-20 financial year from the ATO's Business Por

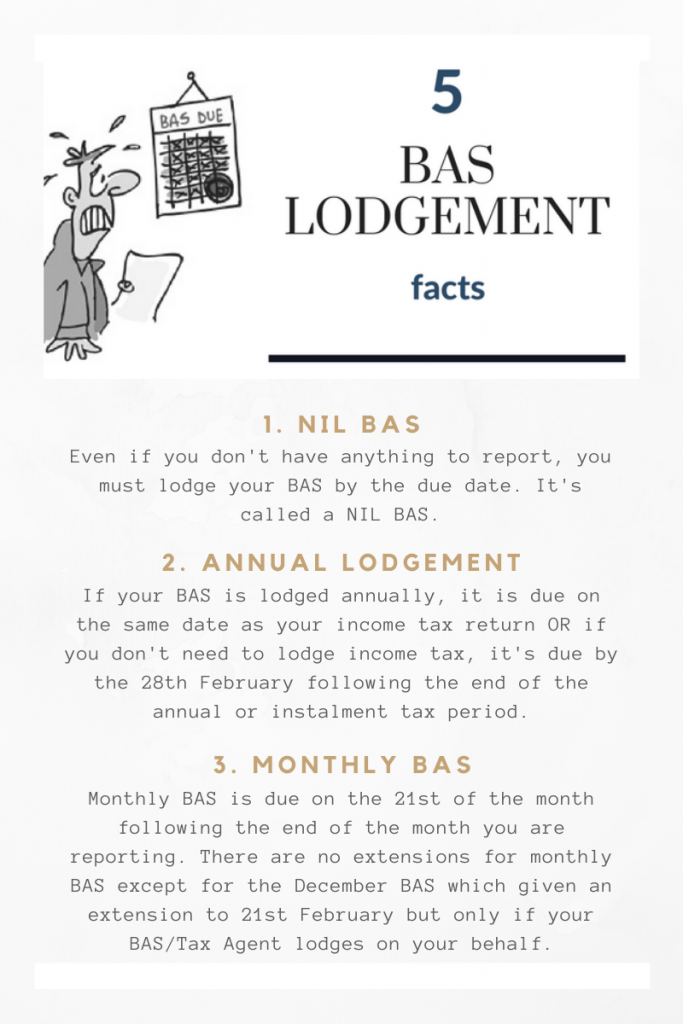

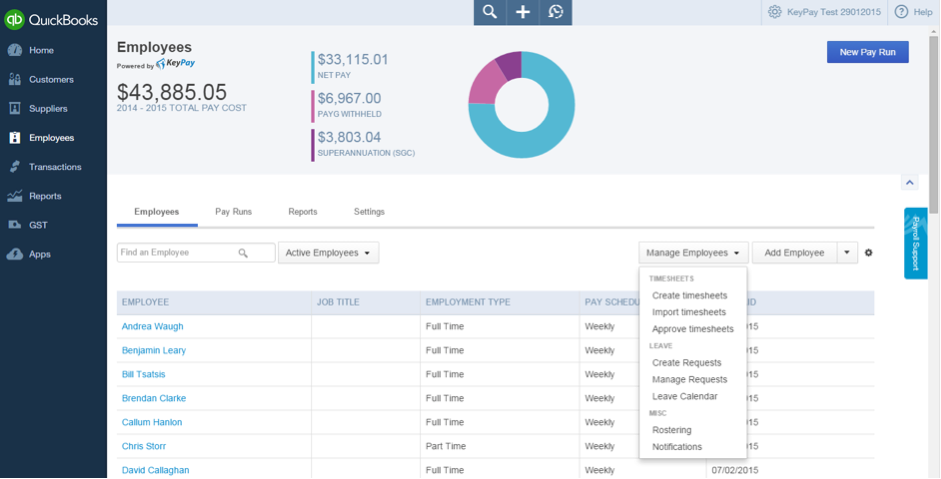

Gold Coast Bookkeeper, Gold Coast Bas Agent, Gold Coast Xero, Arundel Bookkeeper, Gold Coast Cloud Bookkeeper, Gold Coast Bookkeeping Service - BAS Angels